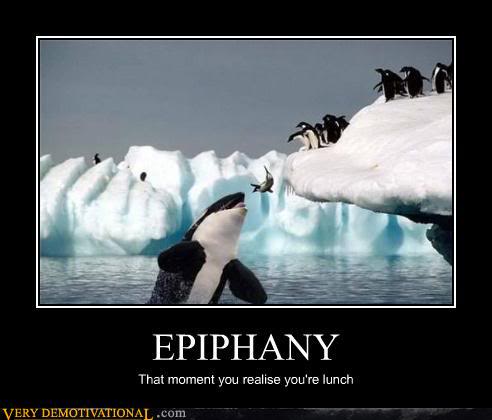

A wise person said, “Death and taxes….both a certainty in life.”

The purpose of an estate freeze is to

1. establish with certainty the amount of the taxes that would be due on the passing of the owner of a business

2. allow the future growth in the value of the shares of the company to accrue to someone other than the owner of the business (often the next generation)

The certainty on the amount of taxes is an aspect of why many families have undertaken an estate freeze. Once these taxes are known, the family could take steps to have funds available to attend to the payment of these anticipated taxes. These contingent plans could include setting aside cash, arranging with a bank for financing or purchasing life insurance…all viable options. In the worst of cases, in Canada, Canada Revenue Agency allows these death taxes to be financed over 10 years and currently charges arrears interest on the outstanding balance at 5% per year.

What taxes are due on the passing of the owner of a business? When a person passes on, all of the assets owned by that person are deemed to be disposed of at fair market value, unless those assets are passed to a spouse, where a tax rollover is available and tax can be deferred. At passing, it is as though the owner sold the shares and all other assets owned and then paid the tax on the deemed gain that would have been realized on the shares. There are certain exceptions in Canada which allow the assets to pass between spouses without income tax.

Estate freezes are technical in the tax implementation and require the input of a person knowledgeable about how to put them into place…generally a tax specialist. Most jurisdictions allow a rollover so that putting the estate freeze into place can be done without creating any income tax immediately.

Have you thought about your estate plan and the possibility of effecting an estate freeze? Consult your tax advisor.

Learn, think, apply!

Recent Comments