Financial literacy needs to be improved. And this from what I have learned is at all ages. It is never too late to begin learning some financial literacy. I have hope. New social media stars are using TikTok and YouTube to engage a younger audience with financial literacy education.

Many do not know some of the basic concepts: simple vs. compound interest, saving 10% of what you earn, what is income tax, good debt vs. bad debt. To create an environment conducive to the succession of your family enterprise, it is up to you to improve the family’s overall financial literacy.

Why. Financial literacy helps the family to have a common language to discuss the present and the future of the business. Why a common language? A business and its operations all boils down to numbers and of course, specialized knowledge. To help the family become more involved, they should have an understanding of where the business has been (historical financial statements) and where it is going (projections/strategy).

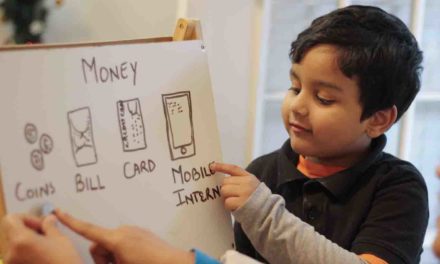

When. Anytime and as soon as possible. Learning about finances can begin even when a child is young. Many financial institutions have introduced financial literacy programs which are age appropriate and are often free. Do not wait to start. Here is one website for young people: Financial literacy for young people

How. Try to gather family members of a similar age. Then commence with the education piece. This financial literacy education can be a part of a family meeting. Make it fun.

Learn, consider, apply!

Recent Comments