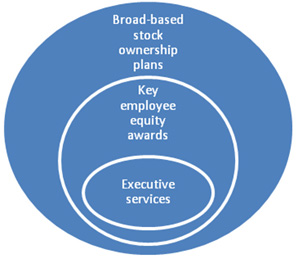

I spoke previously about management becoming owners of the company and why you may do this. There are alternate means of allowing management to either directly be owners of your company or become equity equivalent owners in your company.

The first and simplest form of ownership is to allow your managers to buy shares. They could either buy at current fair market value from you or subscribe for shares from the company. Your preference would be to sell them some shares as this would enable you to partially cash out your shares. The potential pitfalls of minority shareholders can be an issue, in the absence of a clear and understood shareholders’ agreement. Generally a shareholders’ agreement would have buyback provisions in the instance where a manager is no longer employed by the company.

The second form is a phantom stock plan, which is well described here: http://financial-dictionary.thefreedictionary.com/Phantom+stock+plan. This type of plan rewards your managers with the increase in the share price from the date of the grant, which for a private company, can be done based generally on EBITDA. This aligns your interest as owner, and the managers’ interests, in increasing profitability over the long term so that both of you would be rewarded.

The third method is to grant your managers options in the company. This can be a method whereby, they do not have to exercise the options right away yet benefit from the pricing of the shares today. Once exercised, the manager does become a shareholder with the inherent potential issues associated with minority shareholders.

As you can see, you can let managers become shareholders or become “shadow” shareholders. It is up to you.

Learn, think, apply!

Recent Comments