A pet peeve of mine is where the owners of a business either are not interested or have not yet taken the time to learn more about the financial aspects of the business. In these circumstances, the financial literacy for such family members can and should be improved. Many family owners are happy to cash the dividend cheques that they receive without truly understanding the engine that created the ability for the company to pay dividends. Financial literacy is our topic of the day.

Ownership – ownership carries with it rights as well as responsibilities. The rights include access to information on the financial condition and operation of the business as well as the possibility of a return on investment, usually in the form of dividends. The responsibilities are equally important and that is to become informed about the business and to elect the board of directors for the enterprise to run the enterprise.

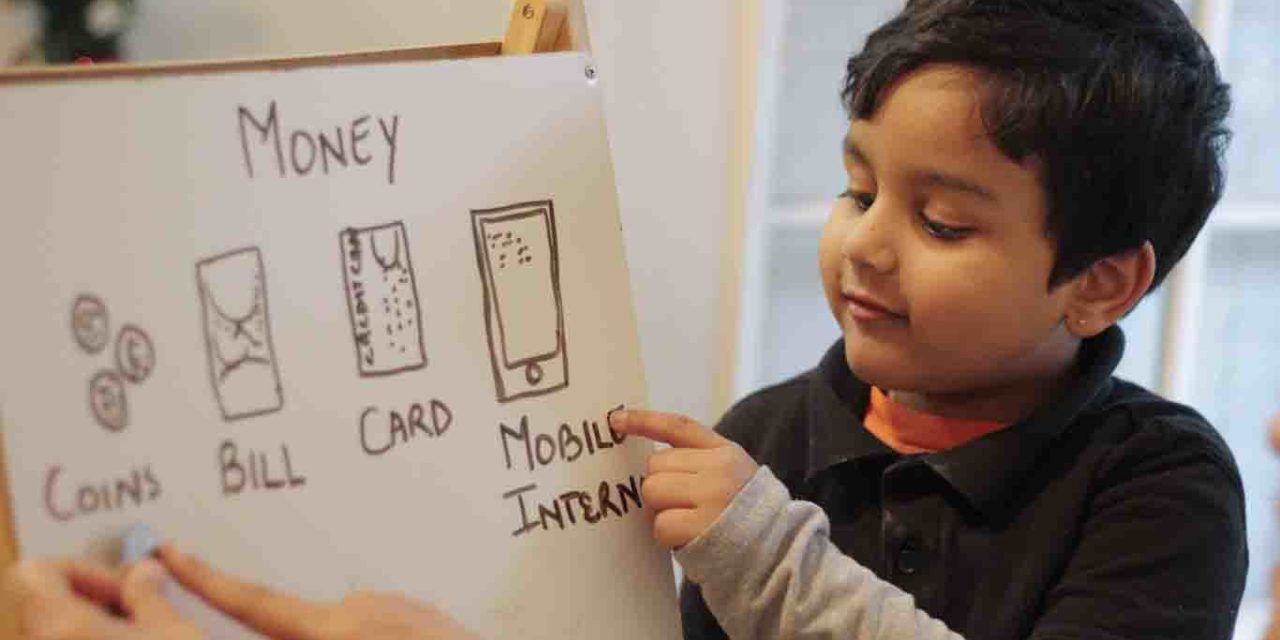

Level of understanding and how to learn? – I am not suggesting that all shareholders/owners have to turn into accountants. It is more important to gain some base level of knowledge to understand the finances of the enterprise for thoughtful input when requested. Financial literacy is often not taught to or shared with owners, explicitly. However, there is much knowledge available from an enterprise’s advisors and resources also available on the internet. An example: Stanford document on reading financial statements

Meeting expectations – in order to be a responsible owner, regular attendance and preparedness at annual or regular owners’ meetings should be obligatory. Some families issue the dividend cheques at the family meetings. No attendance; no cheque. In addition, the enterprise should develop a program to raise the financial literacy knowledge level of its owners.

Shareholder compensation – dividend policy. An enterprise “rewards” its shareholders with either or both of growth in the business value and dividends. Owners should be aware of the potential challenges and conflicts inherent in a business where funds may either be distributed to owners or reinvested in the business. In the Warren Buffett model, he believes that the rate of return within Berkshire Hathaway is superior to the return that a shareholder could earn. Therefore, Berkshire Hathaway has not ever paid a dividend to its owners. This dividend policy is something that is to be discussed and agreed between owners and the board based on the needs of the enterprise, both in the short and longer term.

I hope that this gives you some thought and approaches to improve your financial literacy.

Learn, consider, apply!

Recent Comments