Wealth is not to be taken for granted and it is our job to educate our family members about the responsibility of wealth. We have been very fortunate to have lived through some of the most prosperous growth periods in history. This has afforded us the luxury of offering to our children a lifestyle without much need or want. Our children often work to gain experience, not just to earn a wage. This lifestyle will not and cannot continue for multiple generations.

Let me illustrate. A family has a worth of say $100 million, a lot of wealth. That family has 5 children who inherit the family wealth. When the parents pass, some form of estate tax will be due, let’s say $20 million. The net $80 million remaining is divided between each of the siblings or $18 million each, still a lot of money. These siblings are enjoying life and are not growing the family business so their wealth diminishes….and so on through the generations until the family wealth has been consumed or dissipated. “Shirtsleeves to shirtsleeves in three generations.”

An article here about this topic: Shirtsleeves to shirtsleeves

This outcome can be avoided. How?

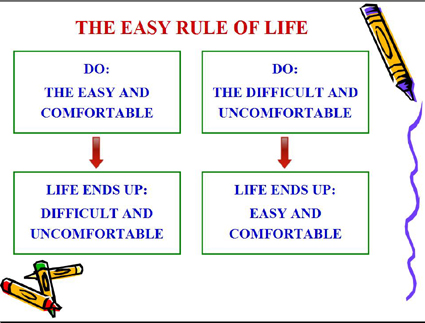

Educating the family with continuous communication that they are caretakers of the family fortune for future generations. It is not theirs to squander. This may mean this generation giving up (delayed gratification) on some things today so that there will remain something tomorrow. Or planting some long term growth seeds, carefully nurtured which will grow in time to create more wealth.

Help and resources are readily available with financial planners and cash flow modeling. Most importantly, creating financial literacy amongst all the generations of the family, whether active in the business or not, will facilitate the conversation around financial responsibility. Financial literacy can help the following generations better understand where and how the wealth was created, likely slowly and carefully so then they would have a better appreciation for what they have.

Start the conversation with your family…..albeit carefully and do it soon.

Learn, think, apply!

Recent Comments