We will take a small detour today from comments directly around succession. I counsel all that I speak with, who are contemplating retirement and ultimately the passing of their business, their assets, their life insurance and their liabilities.

Most of our lives are complicated, so much so that often, you are the only one that knows [or should know] everything about your finances.

In order to make life easier for your grieving beneficiaries and the executor(s) of your estate, you should consider assembling a “death” file. This helps you get better organized and then contemplate your testamentary wishes.

What do I mean by this and how is a death file organized?

A death file contains pertinent, up to date, information about your finances. At a minimum, the file should include:

– key contact particulars of important persons, including your consigliere (do you have one of these?), investment advisor, banker, lawyer and accountant

– a list of assets and liabilities, something like a net worth statement and where these assets and liabilities may be found

– documentation supporting the assets and liabilites listed above.

It’s that simple. This process of assembling the information may be a good refresher for you as to where all of your assets are and maybe even give you pause for reflection about whether or not you wish to continue to remain invested in the asset, the time horizon to a monetization event, or a review of the current value of those investments.

Once assembled, you should revisit this “death” file to ensure that it is relatively up to date. I often do this annually, when I remember.

Hope this helps you become more organized as you continue your journey through a succession plan.

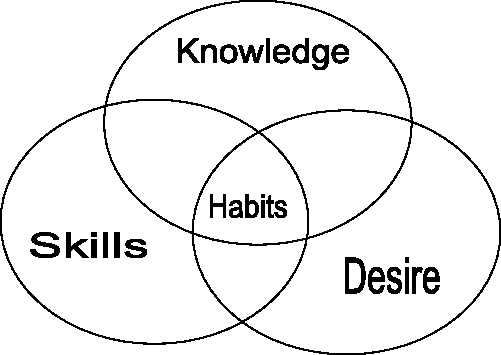

Learn, think, apply!

Thanks.

Recent Comments